2025 Solar Credit Countdown: Don’t Miss Your Chance to Save %30

10.09.2025

10.09.2025

4 minutes read

4 minutes read

If you’ve ever wondered whether now is the right time to go solar, the answer is clear: yes. The federal 30% residential solar tax credit is set to expire for homeowner-owned systems placed in service after December 31, 2025. That deadline changes everything for costs, timelines, and the opportunity to lock in thousands of dollars in savings. EnergySage

As a solar division that has helped Florida families and businesses make the switch, we see how critical this moment is. Contractors are booking out further, permitting delays are becoming more common, and demand is climbing. Homeowners who wait until the last minute risk losing access to one of the most valuable incentives available.

1. Why the Window Is Closing

The tax credit ends for homeowner-owned systems placed in service after 2025. In practice, this means your system must be fully installed, inspected, and operational before year-end. Permitting, utility approvals, and inspection timelines are already adding months to projects in some regions — and those pressures will only grow as the deadline approaches. Kiplinger

The credit was originally designed to accelerate adoption and bring solar costs down nationwide. Those goals have largely been met, but the phase-out means homeowners now face a race against the clock to capture maximum savings. Enphase

2. Why Homeowners Choose Solar

Energy Independence & Resiliency

Florida residents know the risks of storms and outages. Solar paired with battery storage provides backup power and reduces dependence on the grid. A Stanford study found that about 60% of U.S. households could lower bills by 15% while also gaining outage protection with solar plus storage. Stanford Energy

Home Value & Buyer Appeal

Solar doesn’t just lower energy costs — it adds measurable value to a home. Florida further strengthens the benefit with a sales tax exemption on certified solar equipment and a property tax exemption on added home value. Palmetto

Environmental Values

Many homeowners choose solar because it aligns with their values. Generating clean energy reduces reliance on fossil fuels and lowers carbon emissions. Research shows that environmental benefits and social influence strongly motivate adoption decisions. arXiv

Predictability & Inflation Hedge

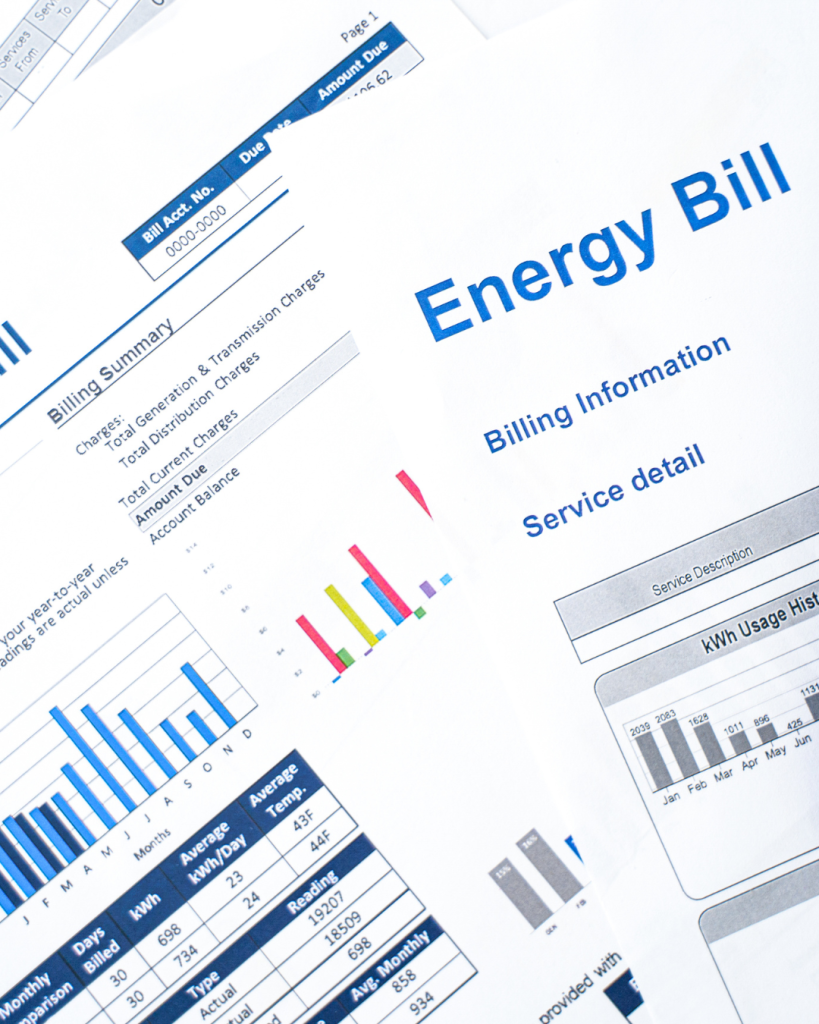

Electric rates historically increase 2–4% each year. Solar helps homeowners stabilize costs, turning an unpredictable expense into a reliable investment. Surveys confirm that saving money and avoiding rising rates are the top motivators for most Americans considering solar. Ohio State News

3. Unpacking the Savings

The 30% Tax Credit

The federal credit reduces your tax bill dollar-for-dollar. For a $25,000 system, that’s $7,500 in savings. If you can’t use the full credit in one year, you can roll it forward into the next tax year. TurboTax

Lifetime Bill Savings

Over the lifespan of a solar system, homeowners can save between $25,000 and $33,000 on electricity. Once the system pays for itself, decades of low-cost energy follow. Yahoo

In Florida, a typical 5 kW system costs around $10,859. With the 30% credit applied, the net cost drops to about $7,601 — immediate savings of over $3,200. EnergySage

Payback & ROI

In Florida’s sunny climate, most systems pay for themselves in 6–12 years. After that, your electricity is essentially free aside from routine maintenance. Current Home

4. How Next Dimension Simplifies the Process

We understand that going solar may feel complex, but our solar division handles the heavy lifting so you don’t have to. From equipment procurement and permitting to utility paperwork and inspections, our team manages the entire process end-to-end. What’s left for you is a seamless experience and the ability to enjoy the benefits of solar without navigating red tape or supply chain issues on your own.

5. The Risk of Waiting

The closer we get to December 2025, the more demand will spike. That means longer queues for permits, inspections, and utility approvals. Even with a signed agreement in hand, delays outside your control can push projects into 2026 — causing homeowners to miss out on thousands in tax credit savings.

By acting now, you lock in the 30% federal credit, protect yourself from rising electricity rates, and secure long-term value for your home. It’s not just about avoiding risk — it’s about taking advantage of an opportunity that won’t be here again. Contact us today to request your free solar energy estimate to find out exactly how the cost of solar compares to your latest utility bills.